Team Member Giving

Discover how your contributions can create meaningful change by watching this video.

Get Involved! Every year, Augusta Health Foundation invites team members to support patient care programs, equipment, and training that enhances the care of our patients and our communities.

If you’re currently using payroll deduction to fund your cause(s), your deduction will automatically continue. If you want to make a change, use one of the options below to let us know.

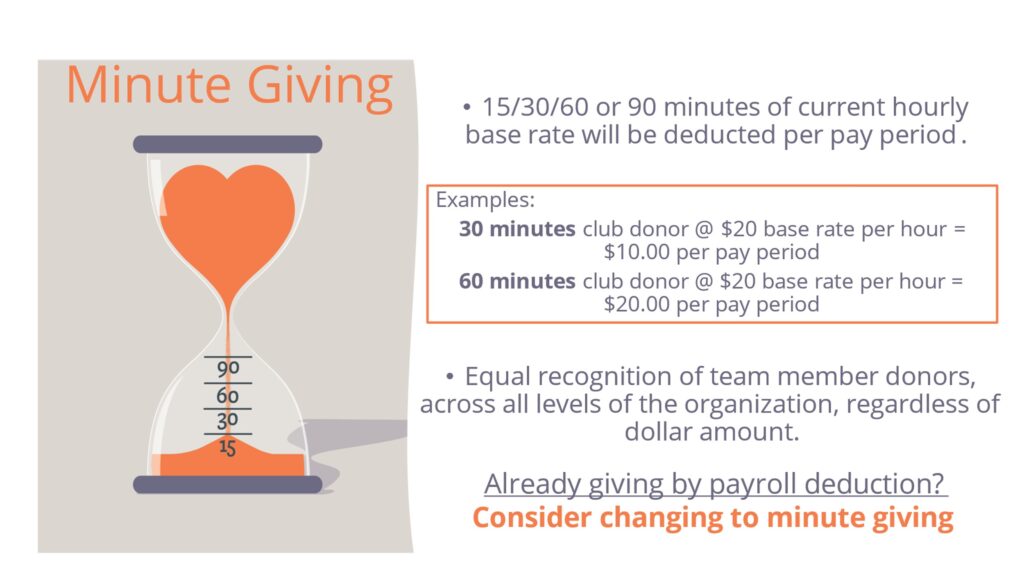

Consider Joining a Minute Giving Club via Payroll Deduction

Find Your Cause!

Now Fund Your Cause!

Frequently Asked Questions

Q. What does Augusta Health Foundation do?

A. Augusta Health Foundation secures support to advance the mission of Augusta Health. Programs and services have been funded and continue to grow through generous gifts to the Foundation. These programs support team members and those we care for in our communities.

Q. Why are we having a Team Member Giving Campaign?

A. You care about your Augusta Health family and your patients. The Foundation supports both. Giving through the Team Member Giving Campaign demonstrates how much you care and how much we, as a team, believe in the mission of Augusta Health.

Q. Can I specify which program(s) my donation supports? Can I give to more than one area?

A. Absolutely! There are many different programs/funds from which to choose. Your gifts can support the Employee Emergency Fund, Hercules Repositioners for patient beds, the Mobile Clinic, or one of the programs and services that help provide exceptional care to those we serve.

You Choose the fund or funds (two-three) you want to support. To learn more about all the Funds, click here for the Fund List.

Q. What is the Team Member (Employee) Emergency Fund?

A. The Team Member Emergency Fund provides short-term assistance to Augusta Health team members in times of personal and economic hardship, like job loss in their immediate family, unexpected death, or an extreme illness. Donors who contribute to this Fund provide critical support that can often make the difference between a setback and a catastrophe. The policy and application can be found on Pulse.

Q. Is my donation tax deductible?

A. Yes! When you donate, you will receive a gift acknowledgment letter by mail for tax purposes. Annual tax statement are also provided in January.

Q. What are my payment options?

A. Payroll deduction, PTO, cash, check, credit card, PayPal, or Venmo.

Q. How does payroll deduction work?

A. Your donation is automatically deducted from your paycheck each pay period based upon the amount of base pay minutes or set dollar amount you specify. Deductions typically start within two pay periods from form receipt.

Q. I can only give a small amount. Will that make a difference?

A. Every gift, no matter the amount, makes an impact and is appreciated.

Q. When is the deadline for making a gift?

A. There’s never a deadline to support the Mission of Augusta Health. During the Team Member Giving Campaign, we hope you’ll make your gift during the month of September. However, you can give any time throughout the year. You can change, start, or stop payroll deduction anytime.

More questions? Contact: ahfoundation@augustahealth.com